P N Gadgil Jewellers Limited IPO Details:

Estimated Post-listing Market Cap: Rs. 6,514 Crores

IPO Date: 10th to 12th September, 2024

Total Issue Size: ~2.29 Cr shares

Fresh Issue: ~ Rs. 850 Crores

Offer for Sale: ~ Rs. 250 Crores

Price Band: Rs. 456 – Rs. 480 per share

IPO Issue Size: ~ Rs. 1100 Crores

Lot Size: 31 shares and multiples thereof

Purpose of Issue: Offer for Sale by Promoter & Fresh Issue

About P N Gadgil Jewellers Ltd Company

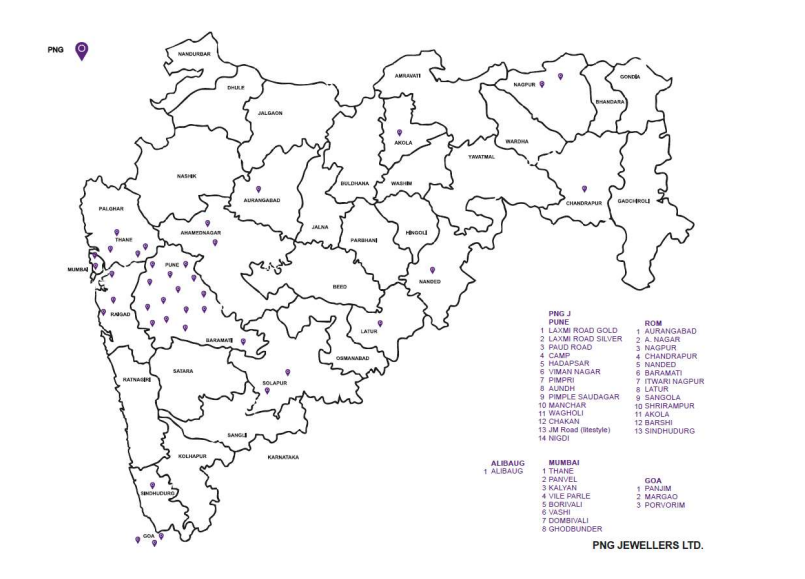

P N Gadgil Jewellers is a prominent Indian jewellery brand with a rich legacy that dates back to 1832. Headquartered in Pune, Maharashtra, the company and its brands are known for the production of jewellery distinctive to the Maharashtra region. It is the second largest jewellery store operator in Maharashtra, after Tanishq (owned by Titan), and has a total of 39 stores across 21 cities in Maharashtra and Goa and one store in the U.S. with an aggregate retail area of approximately 108,282 sq. ft. Overall, 28 stores are company owned and 11 stores are franchisee owned, on a franchisee owned and company operated (“FOCO”) model. The company has eight sub-brands which cater to gold jewellery collections for different occasions, two sub-brands which cater to the diamond jewellery collections and two sub-brands which cater to platinum jewellery collections. These include, ‘Saptam’, ‘Swarajya’, ‘Rings of Love’, ‘The Golden Katha of Craftmanship’, ‘Flip’, ‘Litestyle’, ‘Eiina’, ‘PNG Solitaire’, ‘Pratha’, ‘Evergreen love’, ‘Men of Platinum’, and ‘Yoddha’. The company is promoted by Saurabh Vidyadhar Gadgil, a sixth-generation entrepreneur with over 25 years of experience in the jewellery manufacturing industry in India.

Source: DRHP

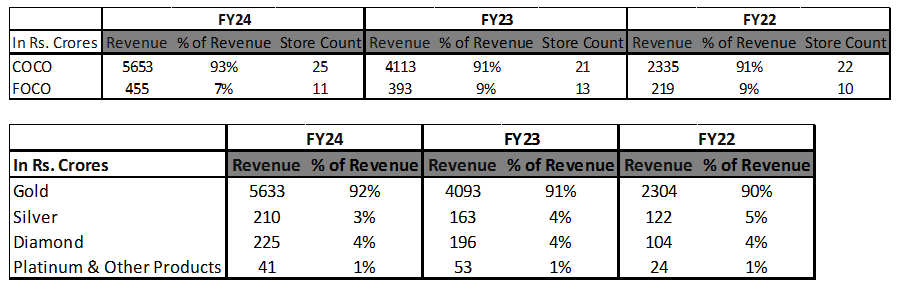

In FY24, the company earned a revenue of Rs. 6,109 crores, with 92.2% of the revenue attributable to gold products and roughly 3.5% each to silver and diamond products. Additionally, 92.55% of the yearly revenue is generated by company-owned and operated stores while accounting for 72% of the store count.

Source: DRHP

Industry Overview

Size

India is the second largest market in the world for jewellery after China. The size of the Indian jewellery retail sector was $70 billion in FY23, and is expected to grow by 16% annually to $145 billion by FY28. Currently, only 37% of the sector is organised, encompassing both national and regional players, while the remainder is dominated by the unorganised segment comprising over 500,000 local goldsmiths and jewellers. Over 95% of gold demand in India is fulfilled through imports, primarily from Switzerland, UAE, and South Africa. Consequently, international gold price fluctuations directly translate into domestic price movements as prices are set internationally by the London Bullion Market Association and denominated in USD. The price of gold is therefore additionally impacted by fluctuations in the price of INR with respect to USD.

Competitive Environment

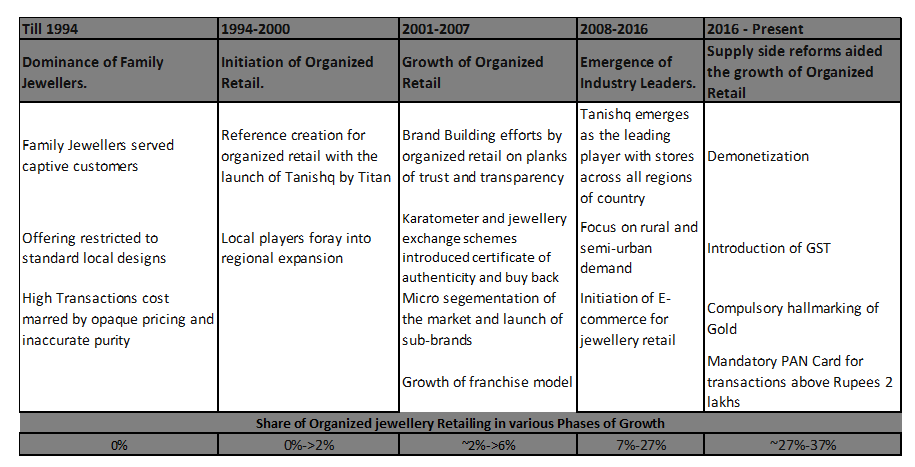

The share of the organised sector is gradually increasing due to the higher financial strength and brand recognition of organised players, as well as government support through regulations.

Source: DRHP

The government has imposed a maximum cash transaction limit of Rs. 2 lakhs for gold purchases without KYC details, preventing money laundering through unorganised players. Furthermore, the government has made 6-digit hallmarking with Hallmark Unique Identification Number (HUID) mandatory for selling or buying gold since 1st April 2023, which has dramatically reduced the incidences of under-caratage and led a shift towards organised players as a large number of unorganised players remain unable to comply with these norms while remaining profitable.

Organised players are able to hedge against fluctuations in gold price through gold on lease facilities, where working capital loans are provided in the form of physical gold for typically 180 days with a lease interest rate between 3% and 8%. This financing method replaces the need for direct gold purchases without credit facilities, which remains a common practice in the unorganised market. Such players may make inventory gains whenever the price of gold increased between purchase and sale, but can also suffer heavy losses when the price of gold corrects, especially when the fall in price is sharp.

Regional

The jewellery market in India can be segmented regionally, as different regions have cultural differences in design and usage of jewellery, the former impacting branding and the latter impact volume of sales. Maharashtra is the third largest market in India with a market size of $8.1 billion in FY23, only smaller than Kerala ($14.4 billion) and West Bengal ($8.8 billion). There are significant barriers to entry for brands trying to create a pan-Indian identity due to cultural differences in style. The size of the market is impacted by population size, state GDP per Capita and traditional usage. Maharashtra ranks strongly along all these metrics, making it a large addressable market.

Seasonality

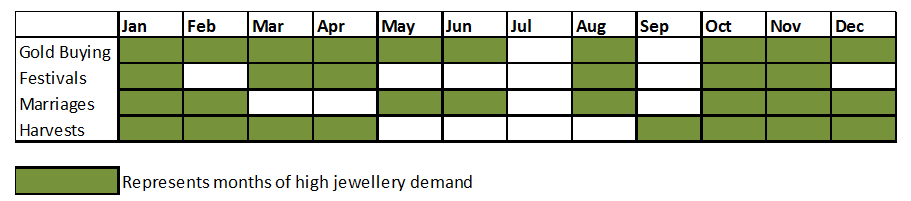

The jewellery retail business is cyclical and dependent on events such as marriages, festivals and harvests, which are not spread evenly across the calendar year. While Tier 2 and Tier 3 cities are impacted by harvests and crop yields more than metros and Tier 1, the impact of marriages and festivals is common across all demographics.

Rural households often invest their harvest proceeds in gold jewellery between September-November and January-March. Additionally, auspicious religious occasions like Diwali/Dhanteras in October and November, and Akshaya Trithiya and Ugadi in April and May, further augment the demand for gold and silver jewellery. Sales in the third quarter and fourth quarter are typically higher than the first quarter and second quarter of the fiscal year.

Source: DRHP

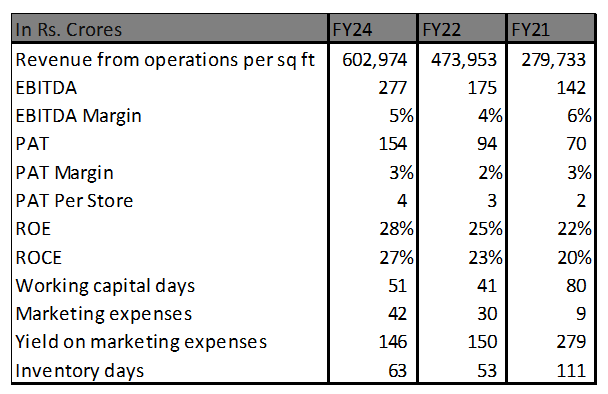

Financial Performance

Source: DRHP

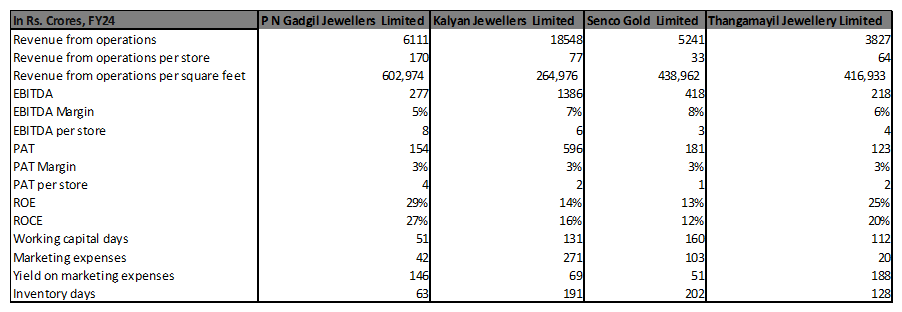

The company will become the third largest listed jewellery company in India, despite having its presence dominated in one city- Pune, which accounts for 65% of sales. The company has the strongest operational and financial metrics compared to peers as reflected through the high ROCE, EBITDA per square feet, and Net Profit per store and low working capital days.

Source: DRHP

Utilisation of Funds

The Fresh Issue of Rs. 850 crores would be used to:

- Set up 12 new stores in Maharashtra under the company owned and company operated model at a cost of Rs. 400 crores. Four stores are proposed to be opened in Pune, four stores in Mumbai, and one each in Nashik, Aurangabad, Solapur and Satara.

- Repayment or prepayment of borrowings worth Rs. 300 crores.

- General Corporate Purposes

The Offer for Sale of Rs. 250 crores is by the promoter, SVG Trust.

Positives

Strong Brand: Since its inception in 1832, the PN Gadgil brand has a strong recollection in Pune, which is the company’s main market. As the company expands its presence across Maharashtra, it is extremely likely that the company will be able to leverage its brand image given the similarities in culture in other cities.

Strong Operational Metrics: The company has extremely high EBITDA per square feet and Profit per Store, which shows that the company is operationally efficient. Furthermore, the high ROCE aided by the low working capital days showcase the company’s financial strength.

Lack of Competition in Maharashtra: The company is the second largest jeweller in Maharashtra even though its presence outside Pune is extremely limited. This suggests that most of Maharashtra remains underpenetrated and is still dominated by the unorganised market.

Concerns

Dependence on one city: Since 65% of the company’s sales come from Pune and top 3 stores contribute 25% of total revenue. Therefore, the profitability metrics may be skewed due to the high profitability of these three stores. In such a case, growth may lead to lower ROCEs and lower EBITDA per square foot.

Management

Saurabh Vidyadhar Gadgil serves as the Managing Director of the company and has been a member of the Board since November 28, 2013. He holds a master's degree in business administration from the Institute of Management Education in Pune, Maharashtra, and has earned a doctorate in philosophy with a focus on business administration from Ballsbridge University in London. With over 25 years of experience in the jewellery manufacturing and trading industry, he brings extensive expertise to his role.

Parag Yashwant Gadgil is an Executive Director at the company and has served on the Board since November 28, 2013. He holds a diploma in mechanical engineering from the Board of Technical Examination in Maharashtra, India. With over 36 years of experience in the jewellery manufacturing and trading industry, he brings significant expertise and knowledge to the company.

Kiran Prakash Firodiya is an Executive Director and the Chief Financial Officer of the company. He joined the Board on February 16, 2023, and has been serving as the Chief Financial Officer since June 1, 2020. He is a chartered accountant with a master's degree in business administration from Allahabad Agricultural Institute, Uttar Pradesh, and a master's degree in commerce from the University of Pune, Maharashtra.

MoneyWorks4me Opinion

P N Gadgil is one of India’s oldest jewellery brands and remains prominent in Maharashtra. Furthermore, the company’s operations are extremely efficient, boasting strong operating and financial metrics. However, the company’s skewed profitability from 3 stores in Pune and high dependence on the city are areas of concern, especially as the company begins to grow in newer geographies. With this context, the company’s expected P/E of more than 40 post listing seems to factor in all the upside.

Recommendation: Avoid

P N Gadgil Jewellers Limited IPO Tentative Timetable:

| IPO Activity | Date |

| IPO Open Date | September 10, 2024 |

| IPO Close Date | September 12, 2024 |

| Basis of Allotment Date | September 13, 2024 |

| Refunds Initiation | September 16, 2024 |

| A credit of Shares to Demat Account | September 16, 2024 |

| IPO Listing Date | September 17, 2024 |

Retail Individual Investor IPO Lot Size:

| Application | Lots | Shares | Amount |

|---|---|---|---|

| Minimum | 1 | 31 | Rs. 14,880 |

| Maximum | 13 | 403 | Rs. 193,440 |

P N Gadgil Jewellers Limited IPO FAQs:

When will the P N Gadgil Jewellers Ltd IPO open?

P N Gadgil Jewellers Ltd IPO will open for subscription on Tuesday, 10th September 2024, and closes on Thursday, 12th September 2024.

What is the price band of P N Gadgil Jewellers Ltd IPO?

The price band for P N Gadgil Jewellers Ltd IPO is Rs. 456-480/share.

What is the lot size for the P N Gadgil Jewellers Ltd IPO?

Retail investors can subscribe to the IPO minimum lot size is 31 shares, up to a maximum of 13 lots i.e. Rs. 1,93,440/-.

What is the issue size of P N Gadgil Jewellers Ltd IPO?

The total issue size is ~ Rs. 1,100 Cr.

When will the basis of allotment be out?

Allotment will be finalized on September 13th and refunds will be initiated by September 16th. Shares allotment will be credited in Demat accounts by September 16th.

What is the listing date of P N Gadgil Jewellers Ltd’s IPO?

The tentative listing date of the P N Gadgil Jewellers Ltd IPO is September 17th, 2024.

What if I do not get the allotment?

If you do not get an allotment of this IPO we recommend you to check out our MoneyWorks4me Core Superstars which helps you build a strong portfolio right away. It offers a Model Portfolio of high-quality stocks Buy/Sell alerts on Quality stocks at a reasonable price and SIP recommendations on stocks. With the help of MoneyWorks4me Core Superstars, you would have picked winners like Asian Paints, Divis Labs, Titan, Pidilite, Cipla, Bharti Airtel, and ICICI Bank.

Download APP

Download APP

Comment Your Thoughts: